Introduction: Beyond the Festive Aisle

The Indian ethnicwear market has long been a cornerstone of the nation’s retail landscape, a vibrant amalgamation of tradition, craft, and culture. For decades, its narrative was one of fragmentation, dominated by unorganised, local players and defined by highly seasonal, occasion-based purchasing.

As of July 2025, that narrative is being decisively rewritten. The market is undergoing a fundamental structural shift, a great reformation from a craft-based ecosystem to a consolidated, brand-driven industry, increasingly shaped by corporate capital and strategy.

The numbers underpinning this transformation are significant. The Indian ethnicwear market, valued at approximately $19.5 billion in the recently concluded fiscal year 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 9% to reach an estimated $28 billion by 2028.

This growth is not merely a continuation of past trends but a reflection of a new, underlying dynamic. The modern Indian consumer’s relationship with ethnicwear is evolving, and corporate India has taken notice, triggering a wave of acquisitions, strategic investments,

Understanding these dynamics is essential for any business aiming to capture value in one of India’s most promising consumer sectors.

Market Sizing & Segmentation: Quantifying the Opportunity

To formulate a coherent strategy, it is imperative to first understand the scale and composition of the market.

The projected growth from $19.5 billion in FY25 to $28 billion by FY28 underscores a resilient and expanding consumer base. This expansion is powered by increasing disposable incomes, rising aspirations, and the growing formalisation of the economy.

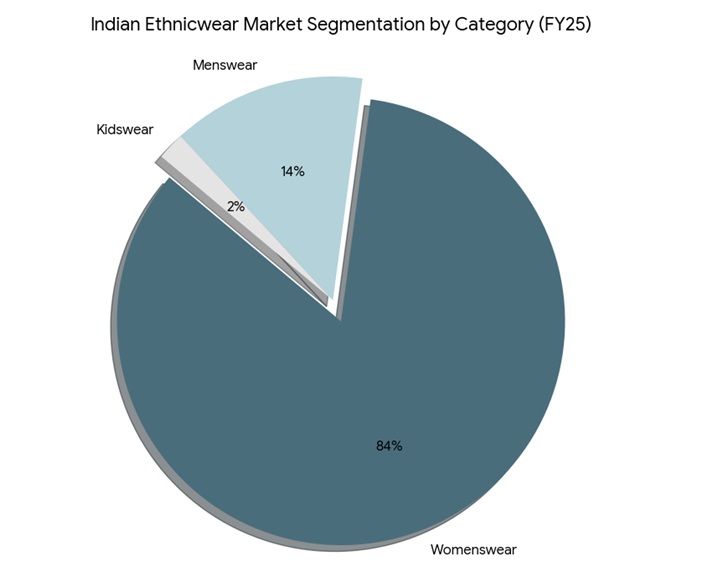

A granular look at the market’s segmentation reveals where the value is concentrated and where the primary opportunities for growth lie.

The category is overwhelmingly dominated by womenswear, which constitutes approximately 84% of the total market value. This segment, encompassing everything from sarees and salwar kameez to kurtas and lehengas, remains the primary driver of sales and innovation. In contrast, the menswear ethnic category, while culturally significant, accounts for around 14% of the market, with kidswear representing a nascent but high-potential 2%.

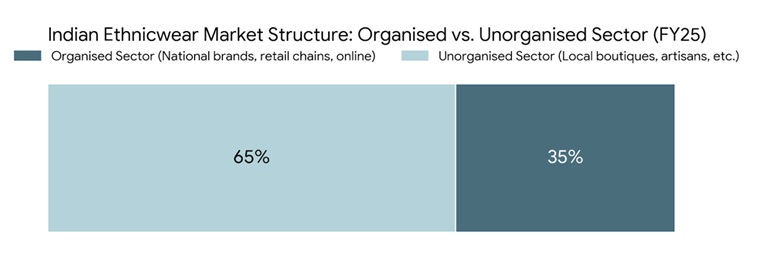

The most critical data point for any strategic analysis, however, is the split between the organised and unorganised sectors.

The most critical data point for any strategic analysis, however, is the split between the organised and unorganised sectors.

As of 2025, the organised sector—comprising national brands, retail chains, and online platforms—accounts for only 35% of the total market. The remaining 65% resides within the unorganised sector, a vast and fragmented network of local boutiques, independent tailors, and regional artisans. This chasm represents the single largest opportunity in the market: the conversion of unbranded consumer spending into branded, organised retail. It is this 65% that has become the primary battleground for the corporate powerhouses and D2C challengers vying for market share.

The Demand Environment: Decoding the Modern Indian Consumer

The growth in the ethnicwear market is not just a function of economic expansion; it is being shaped by profound shifts in consumer behaviour and the overall demand environment. The modern consumer’s interaction with ethnicwear has moved far beyond the traditional confines of weddings and festivals.

A primary driver of this change is the “everyday-ification” of ethnicwear. The strict demarcation between Western formal wear and Indian occasion wear has blurred.

Brands have successfully introduced contemporary silhouettes, breathable and innovative fabrics (such as Liva, Tencel, and viscose blends), and work-appropriate designs.

This has transformed the category from a niche, high-ticket purchase to a staple of the daily wardrobe for millions of Indian women. Analysis of wardrobe shares indicates that fusion and contemporary ethnicwear are steadily gaining space, directly competing with Western wear for everyday use.

Simultaneously, the demand is becoming geographically more democratic. While metro cities remain key markets, a significant portion of new growth is being fueled by Tier 2 and 3 cities.

Increased digital penetration, enabled by affordable smartphones and data plans, has exposed consumers in non-metro areas to national brands and the latest trends.

E-commerce platforms report that a substantial percentage of their ethnicwear sales—in some cases exceeding 50%—now originate from these smaller cities and towns.

This signifies a massive, aspirational consumer base that is ready to upgrade from unbranded local options to organised, branded apparel.

This has also triggered a shift in the consumer’s value proposition. The decision-making process is evolving from a primary focus on price point to a more holistic evaluation of design, quality, fit, and brand narrative.

The influence of social media platforms like Instagram has been instrumental in this shift, turning apparel into a form of self-expression.

Data from online retail platforms shows that products with strong design stories, unique prints, or sustainable credentials can command a price premium, indicating a consumer who is willing to pay more for a differentiated product.

Beyond these secular shifts, the market’s rhythm is dictated by powerful seasonal and cultural drivers.

The demand environment is heavily skewed towards the second half of the fiscal year, with the festive and wedding seasons in Q3 and Q4 accounting for approximately 45% of annual sales. The Indian wedding market, with an average of 10 million ceremonies per year, functions as a critical, non-discretionary demand engine, particularly for the premium and luxury segments.

This intense seasonality places immense pressure on inventory management and supply chain agility, creating a high-stakes environment where accurate forecasting is paramount.

Supply Chain & Sourcing Dynamics: The Core Operational Challenge

While demand is robust, the primary constraints on profitability and scalability lie within the complex supply chain.

The industry is currently grappling with significant input cost inflation, with key raw materials like cotton seeing a 6% year-over-year price increase, while silk and other natural yarns have also experienced volatility.

This directly impacts gross margins, which are already under pressure from competitive pricing.

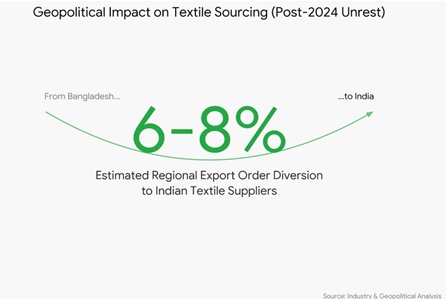

Geopolitical factors are also reshaping sourcing strategies.

The 2024 unrest in Bangladesh’s textile sector, for example, has led to an estimated 6-8% of regional export orders being diverted to Indian suppliers.

While this presents an opportunity, it also tests the capacity and quality control of a domestic supply chain that is still highly fragmented and artisan-dependent.

For brands, this environment necessitates a dual focus: building resilient, local sourcing clusters to de-risk production and investing in digital design and sampling processes to reduce lead times and raw material wastage.

Channel & Distribution Evolution: The Phygital Frontier

The evolution of retail channels is a critical component of the market’s transformation. While offline retail still dominates, the share of online sales is projected to grow significantly through FY2030, driven by both marketplaces and direct-to-consumer (D2C) platforms.

The strategic imperative for brands is no longer a choice between online and offline but a mastery of omnichannel integration.

Leading players are investing heavily in technologies that blur the lines between physical and digital retail. Innovations such as virtual try-ons, assisted video shopping from stores, and seamless “buy-online-return-in-store” (BORIS) functionalities are becoming key differentiators.

On the physical retail front, strategy is also evolving. In regional malls, there is a growing trend towards creating “ethnic clusters,” where beauty, jewellery, and ethnicwear stores are zoned together to increase customer dwell time and encourage cross-category purchasing, creating a holistic lifestyle destination.

Financial Benchmarks: A Tale of Two Sectors

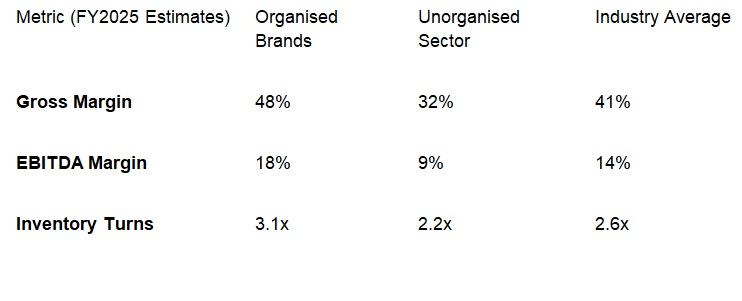

A financial analysis of the ethnicwear market reveals a stark contrast in operational efficiency and profitability between the organised and unorganised sectors. The ability of organised brands to leverage scale, supply chain control, and brand equity translates into superior financial metrics.

These benchmarks highlight the significant operational advantages of the organised players.

These benchmarks highlight the significant operational advantages of the organised players.

Their higher gross margins are a result of better sourcing power and brand-based pricing, while superior EBITDA margins reflect greater operational leverage.

The higher inventory turnover rate (3.1x vs. 2.2x) is particularly critical, indicating a more efficient conversion of inventory into sales, which minimises working capital requirements and reduces the risk of seasonal markdowns—a key challenge in this trend-driven industry.

The Competitive Landscape: The Era of Corporate Consolidation

The single most significant trend shaping the industry today is the entry and expansion of large, well-capitalised corporate entities.

These players are leveraging their financial muscle, retail expertise, and supply chain networks to consolidate the fragmented market, primarily through strategic acquisitions and the launch of new, scalable brands.

The competitive landscape is now composed of several distinct tiers:

- The Corporate Powerhouses: These large conglomerates are aggressively building multi-brand portfolios to cater to a wide spectrum of consumers, from the mass-premium to the luxury segment.

- Reliance Retail: Through its platforms like Ajio and the launch of dedicated ethnicwear chains such as Avantra by Trends, Reliance is pursuing a strategy of scale and accessibility, offering a vast assortment of brands under one roof. The company has also made strategic investments in established designer labels, integrating them into its broader retail ecosystem.

- Aditya Birla Fashion and Retail (ABFRL): ABFRL has adopted a “house of brands” model, executing a series of high-profile acquisitions to build a formidable ethnicwear portfolio. Their strategy straddles the entire price spectrum, from acquiring majority stakes in luxury couture labels like Sabyasachi and Tarun Tahiliani to investing in popular mass-premium brands such as House of Masaba and Jaypore. This allows them to capture value at every level of the consumer pyramid.

- Tata Group: Leveraging the unparalleled trust associated with the Tata name, the group is building a synergistic ecosystem. Its brand Taneira is focused on organising the highly fragmented saree market, while its jewellery arm, Tanishq, caters to the lucrative wedding segment with its Rivaah collection, creating powerful cross-promotional opportunities.

- The Scaled Legacy Brands: These are the established leaders who have successfully transitioned from family-run businesses to national retail powerhouses. Brands like Manyavar (which dominates the men’s ethnicwear space), Biba, W for Woman, and Fabindia have built extensive physical retail footprints and strong brand recall over many years, making them formidable incumbents.

- The D2C Challengers: A new wave of digitally native brands is leveraging online channels to build strong, niche communities.

Brands such as Libas, House of Chikankari, and The Loom have used social commerce, influencer marketing, and quick trend cycles to scale rapidly.

The growth rate for D2C brands in the ethnicwear category has consistently outpaced that of the broader apparel market, demonstrating the power of a digital-first approach.

Structural Headwinds & Macro-Economic Impact

Despite the positive demand environment, the ethnicwear industry is fraught with deep-seated structural challenges and is susceptible to macro-economic volatility. These headwinds can significantly impact profitability and scalability.

The most significant challenge lies in supply chain fragmentation. Unlike the fast-fashion industry, which relies on large, consolidated manufacturing units, a significant portion of ethnicwear production is dependent on a scattered network of small-scale artisans, weavers, and printing units.

This creates immense complexity in ensuring quality control, production consistency, and on-time delivery at scale. The high degree of manual dependency makes the supply chain less agile and more vulnerable to disruptions.

This complexity feeds directly into the challenge of inventory and SKU management. The ethnicwear market is characterised by immense regional taste variations, high seasonality tied to a diverse calendar of festivals, and fast-changing design trends.

A design that is a bestseller in North India for Diwali may have no takers in the South during Pongal. This requires brands to manage a vast and complex array of SKUs (Stock Keeping Units), leading to a high risk of inventory obsolescence and the need for deep seasonal discounting, which erodes gross margins.

Furthermore, the industry is exposed to macro and geopolitical factors:

- Commodity Price Volatility: The prices of key raw materials like cotton, silk, and viscose yarn are subject to global commodity market fluctuations. Any significant rise in these prices directly impacts the input costs for manufacturers, putting pressure on margins in a price-sensitive market.

- The GST Framework: The multi-slab Goods and Services Tax (GST) structure for textiles and apparel creates operational complexity. Different tax rates on various fabrics and price points require sophisticated compliance systems and can impact final pricing strategies, especially for brands operating across multiple product tiers.

The Strategic Outlook: Pathways to Growth for 2025 and Beyond

For brands and investors seeking to navigate this evolving landscape, success will be determined by the ability to address the industry’s structural challenges while capitalising on the new consumer trends. Several strategic imperatives are clear:

- The Phygital Imperative: The future of ethnicwear retail is neither purely online nor offline; it is a seamless integration of both. The winning model is a “phygital” one, where online platforms are used for discovery, brand building, and social commerce, while physical stores provide the essential touch-and-feel experience, personalised styling, and experiential retail. The trend of successful online-first brands like Libas investing in a physical retail footprint underscores the necessity of this omnichannel approach.

- Continued Consolidation and M&A: The era of corporate consolidation is still in its early stages. We anticipate continued merger and acquisition activity as the large corporate houses seek to fill gaps in their portfolios by acquiring strong regional players, niche D2C brands with dedicated followings, or companies with unique supply chain capabilities.

- Focus on Value-Added Niches: As the mass market becomes more competitive, significant growth will come from underserved or emerging sub-segments. These include sustainable and eco-friendly ethnicwear (appealing to the conscious consumer), the rapidly growing plus-size apparel market, and contemporary fusion wear that blends Indian aesthetics with global silhouettes.

- Technology as a Core Differentiator: The brands that will win are those that embrace technology as a core competency. The use of AI and machine learning for demand forecasting can drastically reduce inventory risk. Implementing technology for real-time supply chain visibility can improve production efficiency and quality control. Digital tools for 3D sampling and virtual try-ons can shorten design cycles and enhance the online customer experience.

Conclusion: Weaving a Modern Future

The Great Indian Wardrobe Reformation is well underway. The ethnicwear market is at a pivotal moment, transitioning from a fragmented, craft-based past to a structured, corporate-led future.

The sleepy, predictable rhythm of festive seasons is being replaced by the dynamic, year-round hum of a modern apparel industry.

The challenges are significant, rooted in the deep complexities of the supply chain and the volatility of the economic environment.

However, the opportunities are even greater. The consumer is sending clear signals: they want brands that respect tradition but embrace modernity; that offer beautiful design but also stand for quality and transparency; that are accessible online but also tangible in a physical space.

The future leaders of the Indian ethnicwear market will be the entities that can master this duality—building aspirational, consumer-centric brands on the front end, while simultaneously engineering a resilient, efficient, and technology-enabled supply chain on the back end.

The process will be complex, but for those who can successfully weave together these threads of tradition and transformation, the prize will be a dominant share in one of the world’s most exciting consumer growth stories.