Can BlueStone Take on Titan and Kalyan in India’s Gold League?

Backed by marquee investors and buoyed by strong omnichannel momentum, BlueStone is aiming for a Rs.7,800 Cr valuation as it files for IPO. Here’s how the brand has evolved into a modern jewellery powerhouse with a tech spine and retail muscle.

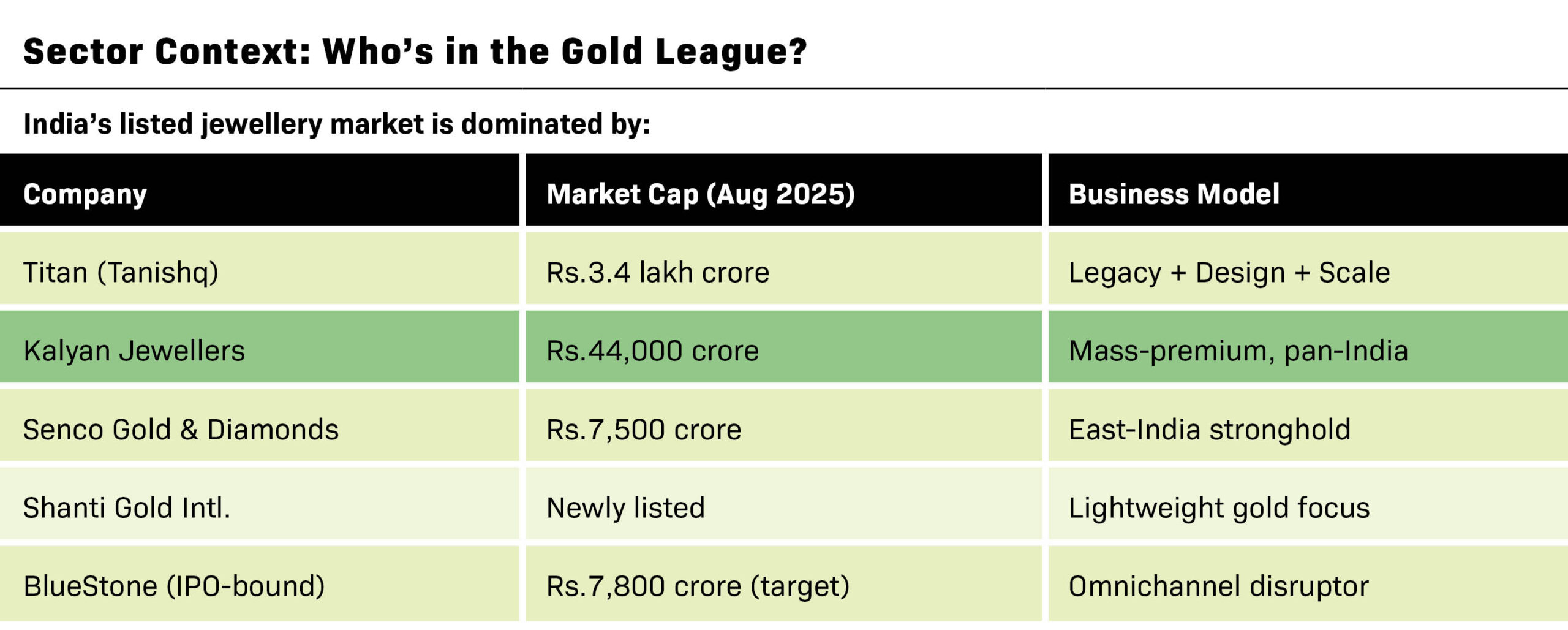

India’s gold jewellery industry — once defined by family-run stores and regional legacy brands — is now witnessing the rise of digitally native disruptors. At the forefront of this transformation is BlueStone Jewellery & Lifestyle Ltd, which has not only challenged conventions in this tradition-rich segment but is now preparing to go public at a valuation of Rs.7,800 crore ($888 million).

Founded in 2011 by IIT Delhi alumnus and former Amazon executive Gaurav Singh Kushwaha, BlueStone was one of the earliest movers in India’s online fine jewellery space. Today, it operates more than 300 stores, generates Rs.1,000 crore+ in revenue, and is positioned as a serious challenger to established giants like Titan (Tanishq), Kalyan Jewellers, and Malabar Gold & Diamonds.

IPO Snapshot: BlueStone’s Big Bet

According to its Red Herring Prospectus (RHP) and reports from Moneycontrol, the IPO will open for public subscription from August 11 to August 13, with August 8 reserved for anchor investors.

Key IPO Details:

- Fresh Issue: Rs.820 crore

- Offer for Sale (OFS): Up to 13,939,063 equity shares

- Estimated Valuation: Rs.7,800 crore

- Use of Proceeds: Working capital, inventory expansion, general corporate purposes

- Lead Managers: Axis Capital, Kotak Mahindra Capital, IIFL Capital

- Legal Advisor: Trilegal

- Promoter Holding: Gaurav Singh Kushwaha (17.7%)

- Top Institutional Investors: Accel (11.68%), Sunil Kant Munjal (5.61%), Kalaari Capital (5.12%), Saama Capital, IvyCap Ventures, IronPillar

This listing marks one of the most significant IPOs in the jewellery retail sector since Titan’s scale-up decades ago — and comes on the heels of Shanti Gold International’s successful debut and Lalithaa Jewellery’s upcoming Rs.1,700 Cr issue.

READ MORE: BlueStone Ahead of IPO: 300 Stores and a Rs. 1,000-Crore Glint

Omnichannel Blitz: 300+ Stores and Counting

BlueStone’s offline journey — a bold move for a digital-first brand — began in 2018. As of July 2025, it operates over 300 company-owned, company-operated (COCO) stores across metros, Tier 1, Tier 2, and now Tier 3 cities. About 60% of new store openings in FY25 were in non-metro markets, where organised jewellery penetration is still under 15%.

Retail Strategy Highlights:

- In-store conversion rate: 50%+ (significantly above industry average)

- Average store size: 1,000–3,000 sq. ft.

- Payback period: 18–24 months

- Store design: Modular, asset-light formats for faster scale

Financial Glint: Revenue, Growth & Profitability

BlueStone has shown robust topline growth over the past three years:

- FY23 Revenue: 787 crore

- FY24 Revenue (Estimated): 950–Rs.1,000 crore

- FY25 Revenue (Projected): 1,350–1,400 crore

More than 80% of sales now come from offline stores, while online contributes 15–20% — mainly through repeat buyers in metros and assisted digital selling formats.

The BlueStone Edge: What Sets It Apart

- Product Play

- Specialises in 18K–22K gold fine jewellery — rings, earrings, pendants, bracelets, and men’s jewellery

- Over 8,000 active SKUs with regular limited-edition drops

- Focus on wearable, lightweight pieces for self-use and gifting — a sharp contrast to the bridal-heavy assortments of traditional players

- Design-Led, Tech-Enabled

- In-house manufacturing in Bengaluru and Jaipur with CAD design, gemstone standardisation, and rapid prototyping

- Concept-to-store turnaround time: 30–45 days

- Use of AI/ML for merchandising, footfall analytics, demand forecasting

- Digital First, Data Always

- Sophisticated CRM stack for:

- Life-stage marketing (e.g., birthdays, anniversaries)

- Dynamic pricing models

- Appointment-based store visits (popularised during COVID, now institutionalised)

- Online-to-offline (O2O) flow via WhatsApp, email, and in-store QR-led catalogues

What’s Next: Future Outlook

What’s Next: Future Outlook

Post-IPO, BlueStone is expected to double down on:

- Store expansion to 500+ outlets by FY27

- Higher inventory depth and personalization per region

- Entry into silver jewellery and watches

- Global e-commerce push targeting NRIs in the US, UAE, and Singapore

- Creating phygital experiences with virtual try-ons, smart mirrors, and AR-enhanced in-store trials

The company’s roadmap suggests a Titan-for-the-younger-generation ambition — balancing trust with tech, and tradition with tempo.

BlueStone’s IPO signals a pivotal moment not just for the brand but for India’s fine jewellery sector. It validates the potential of an omnichannel, vertically integrated, tech-native jewellery company to scale profitably in a category long dominated by legacy players.

As consumers move from chunky bridal buys to frequent, expressive, wearable luxury, BlueStone is positioned to become more than just a retailer — it may well emerge as India’s first true lifestyle jewellery brand for a new era.

Its sparkle isn’t just in carats. It’s in clarity — of purpose, execution, and future vision