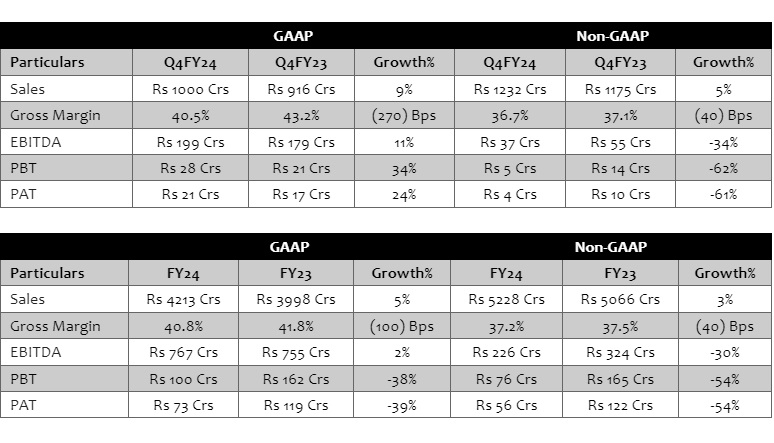

Leading department store Shoppers Stop Ltd. – which hosts many premier fashion and beauty brands – has declared its results for the quarter ended 31st March 2024. The following are the key financial highlights for Q4 FY24 and Fiscal Year 2023-24:

Commenting on the Q4FY24 results, Kavindra Mishra, Managing Director and CEO, Shoppers Stop Ltd, said, “Shoppers Stop delivered consistent performance despite continued softness in demand. We remain focused on driving operational excellence and our long-term goal is to increase the overall margins. I am happy to say that we have made concerted efforts to further improve and sustain our excellence in customer journey, which is evident with our loyal customers contributing 78% of our total sales. With rising affluence, our focus on premiumisation continues to drive ATV by 8%. Beauty category sustained the strong momentum in Q4. We launched largest beauty store in the country at Quest Mall, Kolkata.”

Commenting on the Q4FY24 results, Kavindra Mishra, Managing Director and CEO, Shoppers Stop Ltd, said, “Shoppers Stop delivered consistent performance despite continued softness in demand. We remain focused on driving operational excellence and our long-term goal is to increase the overall margins. I am happy to say that we have made concerted efforts to further improve and sustain our excellence in customer journey, which is evident with our loyal customers contributing 78% of our total sales. With rising affluence, our focus on premiumisation continues to drive ATV by 8%. Beauty category sustained the strong momentum in Q4. We launched largest beauty store in the country at Quest Mall, Kolkata.”

“During the quarter, sales grew by 9% and EBITDA at Rs 199 crore. Our EBITDA was impacted by one-time investments in beauty and write offs of inventory aggregating to Rs 14 crore during the quarter. In Q4, we opened 7 departmental stores, 3 beauty stores and 12 Intune stores. Our investments in opening new stores continues and we have opened 55 stores, including our new business, Intune wherein we opened 22 stores during FY24,” he added.

“I am confident of the medium to long-term potential of retail growth, with a key thrust on ‘Growing our Core’ through an impeccable customer journey, premiumization and having our portfolio in high growth spaces,” he further stated.

Performance of strategic pillars in Q4-FY24:

- First Citizen – Our First Citizen Members contributed 78% sales, of which 65% were repeat and 13% new members. Our Premium Black Card contributed 12%. During the quarter we added 180K members and total base at the quarter end is 9.9 million. The customer engagement continues to be strong. We launched a playbook for regional festivals, used online gamification as a content driver for Valentine’s Day as well as had an SS’24 season launch, micro-personalisation, videos and campaigns for Women’s Day leading to 2X response rate etc. and many other campaigns.

- Private Brands – Private Brands sales stood at Rs 145 crore. Challenges continue to remain in the private brand segment with weak demand in women’s western and men’s category. However, our inventory reduced by Rs 56 crore (25% YoY).

- Beauty – Beauty sales, at Rs 218 crore, grew by +7% and continued to outperform other categories contributing 18% to the overall sales. During the quarter, we opened India’s largest beauty store at Quest Mall in Kolkata, spanning a sprawling 9000 sq ft. We created a Guinness World Record for completing the most makeovers in 1 hour on the store launch day. We had 220K makeovers this quarter. We also launched 2 EBOs during the quarter.

- INTUNE – Our ‘Fashion for All’ format, INTUNE has been one of the most promising and fastest-growing segments. We have added 12 new stores during the quarter and entered 3 new cities. At the end of FY24 we have 22 Stores in 9 cities. The initial success in INTUNE has been encouraging.

- Beauty Distribution – Beauty distribution business recorded Rs 42 crore sales during the quarter. Distribution network expanded to over 436 doors from earlier 334 doors. We launched the NARS brand boutique store at Select City Mall, New Delhi. With the addition of fragrance brand Maison Margiela and makeup brand Note Cosmetics, our total brand portfolio expanded to 20.

- Store Expansion – We launched 22 stores during the quarter (7 Departmental, 12 INTUNE and 3 Beauty stores). The company has made a capex investment of Rs 84 crore during the quarter and Rs 246 crore during FY24.