The U.S. has levied a total 50% tariff on Indian textiles and apparel—comprising an initial 25% and an additional 25% penalty tied to India’s oil imports from Russia. This tariff spike is one of the steepest among India’s trading partners and places Indian exporters well behind competitors like Bangladesh, Vietnam, and Cambodia, whose tariffs range between 19%–20%. For specific products, effective duties can shoot up as high as 64% (e.g., knitted garments).

Devastating Ripple Effects on Ground-Level Operations

Textile hubs such as Tiruppur, Ludhiana, Coimbatore, and Karur are reeling from order cancellations and production halts. According to Reuters, some factories in Tiruppur have been asked by customers to hold orders, while others plan to ship as many goods as possible before the full 50% tariff kicks in.

And that is not all. Employment is slated to take a hit with hundreds of thousands being impacted as MSMEs struggle to cope with thinning margins (5-7%), increased input costs and clients in the US asking textile producers to bear the tariff.

While some bigger producers are shifting their order production to their foreign factories, domestic textile producers are said to be the worst hit.

Industry leaders are calling the tariffs a “death knell” to competitiveness, with a mass exodus of orders to lower-cost nations.

“Across all product categories, India’s contribution is barely in the single digits. This indicates that US brands have alternative supply bases for these products, and volumes could be shifted quickly if the tariff issue is not resolved,” says P Senthilkumar, Partner at Vector Consulting Group.

“The US is India’s largest market, accounting for 33% of apparel exports. Earlier this year, Trump’s proposed lower tariffs for India compared to Bangladesh, Vietnam, and China were seen as an opportunity to grow in the $16 billion US apparel market. However, geopolitical shifts have reversed the advantage. India now faces a 50% tariff, compared to 20% for Bangladesh and 30% for China—a gap that erodes competitiveness. Many exporters are halting US-bound orders, with shipments being made at losses. Tariffs are expected to cause a decline in exports, reduced margins, job cuts, and uncertainty in this labour-intensive sector,” he continues.

“The industry is seeking lower tariffs for a bilateral agreement with the US, something like what Vietnam achieved. But companies can’t simply count on that. As margins are expected to reduce, large players with ~75% exports to the US, are exploring relocation, diversification, and US acquisitions. Smaller exporters, however, lack such resources. At this stage, we are only evaluating the situation and possible scenarios—the full impact will only become clear once the final outcomes of the tariff revisions are known,” P Senthilkumar further added.

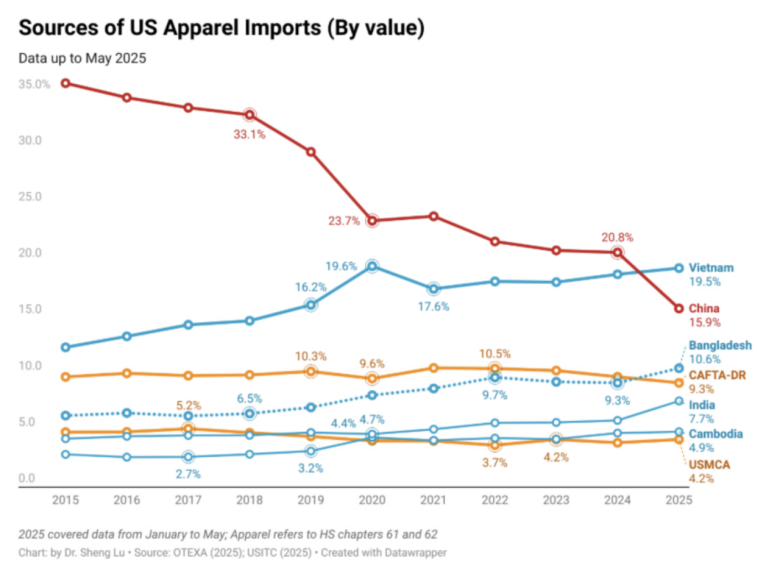

P Senthilkumar illustrates this with the following data & graph:

US total apparel imports – $80bn

Out of that, India’s share is ~6% (~$4.8bn)

Breakup of US apparel imports – China (21%), Vietnam (19%), Bangladesh (9%), India (6%), and Sri Lanka (3%)

Apparel; knitted

Current tariff – 13.9%

Expected tariffs after revision – 63.9%

Apparel; woven

Current tariff – 10.9%

Expected tariffs after revision – 60.9%

However, out of India’s total apparel exports, 33% goes to the US.

Product wise information:

| Top 5 products imported by US | Imported from India Mn USD | Total Mn USD | India’s share |

| Jerseys, pullovers, cardigans, waistcoats and similar articles, of cotton (knitted or crocheted) | 425 | 7240 | 6% |

| Jerseys, pullovers, cardigans, waistcoats and similar articles, of manmade fibres (knitted) | 33 | 5034 | 1% |

| T-shirts, singlets and other vests of cotton (knitted or crocheted) | 368 | 4881 | 8% |

| Men’s or boys’ trousers, bib and brace overalls, breeches and shorts, of cotton | 123 | 4597 | 3% |

| Women’s or girls’ trousers, bib and brace overalls, breeches and shorts of cotton (excl. knitted) | 116 | 3894 | 3% |

CMAI Expresses Deep Concern

The Clothing Manufacturers Association of India (CMAI) has expressed deep concern over the United States’ decision to further increase tariffs for from 25% to 50%, calling it a severe setback to Indian apparel exports. It has also cautioned that such elevated duties could severely destabilise the Indian apparel industry and leading to factory closures, unemployment, and widespread economic distress.

“The imposition of an additional 25% tariffs on India will deliver a crippling blow to the Indian apparel industry. The proposed 50% tariff will increase the cost of Indian apparel by 30–35% compared to alternatives from countries like Bangladesh and Vietnam, making Indian exports uncompetitive in the global market. Buyers are unlikely to bear such a substantial pricing gap, which could lead to a sharp decline in export orders,” says Santosh Katariya, President of Clothing Manufacturers Association of India (CMAI). He further denounces the move as “unjustified, unfair, and arbitrary.”

Ankur Gadia, Vice President of Clothing Manufacturers Association of India (CMAI), adds to this saying, “We urge the Government of India to take a firm and proactive stance on this matter and work towards negotiating more balanced and equitable trade terms with the United States.”

Rahul Mehta, Chief Mentor of Clothing Manufacturers Association of India (CMAI), states, “While we continue to hope that this development is part of a broader negotiation strategy, we strongly recommend that both the Government and the industry collaborate urgently to devise measures that can mitigate the adverse impact of this draconian levy.”

CMAI anticipates that the coming months will be extremely challenging for the Indian apparel export sector and calls for strategic intervention to safeguard the industry’s long-term viability.

Impact on the Jewellery Sector

Tariffs now affect a spectrum of industries beyond apparel—diamond polishing, carpets, shrimp, chemicals, and more—threatening the broader export ecosystem. Among these, the jewellery sector has been severely hit.

“The US’s decision to double tariffs to 50% has immediately halted shipments and frozen orders from India’s jewellery sector, which represents approximately $11.58 billion in exports to the U.S. in 2024, accounting for 12.99% of the US’s total jewellery imports. This escalation of duties significantly undermines India’s competitiveness, particularly when compared to countries like the UAE and Mexico, where tariffs remain significantly lower. The financial impact is severe, potentially stalling nearly 30% of India’s jewellery exports, with key manufacturing clusters like SEEPZ in Mumbai seeing order losses amounting to $7–8 billion. Major products such as cut and polished diamonds (45.09%), gold jewellery (24.61%), and worked lab-grown stones (92.17%)—which form a significant portion of India’s exports to the US-are facing critical disruptions. Gold and diamond-studded jewellery, already facing 5.5-7% tariffs, are now pushed above 50%, making them unviable in the US market,” says Namita Kothari, Founder at Akoirah by Augmont.

“Relocating manufacturing to the UAE or Mexico to bypass the higher U.S. duties presents both opportunities and challenges. The UAE, with its 10% duty, offers a potential escape route, allowing manufacturers to continue serving the U.S. market via re-exports. However, such a shift would come with substantial operational and compliance challenges-including higher production and logistics costs, regulatory hurdles, and strain on supply chains. Additionally, it could require significant upfront investment in new facilities and compliance systems. While it offers a viable alternative, such a transition is far from straightforward and requires careful consideration of the long-term costs and benefits,” Kothari further states.

“Without immediate government relief, such as duty drawback schemes or interest deferment, and proactive trade negotiations to lower U.S. tariffs or establish favorable trade agreements, the financial hit will be long-lasting and challenging to recover from,” she adds.

“With the current tariff system, I feel specially the high import duties and the high cost of gold & other raw materials is creating lots of challenges for the jewellery business in India. It definitely makes the cost of making go higher, and in turn reduces the profit margins. It may even push people to pursue illegal ways of importing gold. So in this way, it affects everyone. Be it local artisans or big jewellers, all of us get impacted by this. It makes it very hard for Indian brands to compete globally. To solve this, India really needs to rethink this policy by lowering import duties and making it easier to get quality materials which can support skill development and design innovation, this will in turn help the industry grow. The government should help to build a strong ecosystem that supports quality, creativity and ethical ways of sourcing. This way Indian jewellery will be able to shine both domestically & internationally,” says Sonal Sawansukha of Jewel Saga.

Neha Chelani – Fine Silver Jewels says, “With the U.S. set to impose a blanket 25% tariff on Indian imports beginning August 1, 2025, our brand’s jewelry exports face an unprecedented challenge. The United States accounts for a big number in our brands exports and this hike inflates costs and squeezes margins across the value chain, thus affecting the sales. Looking into the scenario the brand will focus its strategies towards other foreign and domestic markets until there is a fair resolution to the current tariff imposed by the U.S. As a country, such trade barriers are disheartening, and that also when it is related to the biggest economy in the world. Having said that, I have full faith that our government will take necessary steps in favor of India and Indians.”

“The imposition of a 25% tariff by the U.S. administration presents both a challenge and a catalyst for introspection within the Indian jewellery export ecosystem. While such policy shifts can momentarily affect pricing structures and margins, they also reinforce the need for long-term resilience, self-reliance, and innovation. At Mirāsa Jewels, we remain committed to upholding the excellence of Indian craftsmanship while navigating global market dynamics with agility. India’s fine jewellery industry rooted in centuries of artisanal heritage, cannot be defined by geopolitical headwinds. Instead, this moment pushes us to reimagine our value chain, invest in strategic retail partnerships, and explore more direct-to-consumer channels globally. The true value of Indian jewellery lies not just in its material worth, but in the cultural and artistic legacy it represents something that no tariff can diminish,” adds Rishi Jain- Mirāsa Jewels.

Governmental Response & Market Diversification

Rating agencies, including Moody’s, warn that prolonged tariffs may undermine India’s “Make in India” ambitions, deter foreign investment, and dent manufacturing viability. However, in a quick response, the Indian government has unveiled a ₹40 billion (~$480 million) credit guarantee scheme offering 10–15% coverage, plus term loans with up to 75% guarantees for MSMEs.

Export diversification too is underway, with India is redirecting focus toward Europe, Africa, Central Asia, and Southeast Asia, while pushing for new FTAs.

“Having seen the several about turns on the tariff front in the case of other countries, I would not press the panic button just now. However, if the proposed terms do come into effect, It will make our products 7% to 10% more expensive than some of our competitors, and it will certainly hurt our Apparel exports to the US. Fortunately, this set-back has come at the time when we have just signed an FTA with UK, and are proceeding rapidly with an FTA with EU. So yes, it is tough times, but not beyond our ability to face,” says CMAI’s Rahul Mehta.

Meanwhile, trade bodies like AEPC and CITI are lobbying for quicker policy support to reduce manufacturing costs and negotiate relief.