THE GROWTH OF DENIM APPAREL IS ALSO DRIVEN BY THE INCREASING ACCEPTANCE OF DENIM WITHIN INDIA. CONSUMERS, ESPECIALLY THE YOUTH, IN CITIES BEYOND THE METROS AND MINI METROS ARE EXCEPTIONALLY ASPIRATIONAL. THEY ARE INCREASINGLY ACCEPTING DENIM AS A CORE APPAREL CATEGORY TO BE WORN AS AN EVERYDAY CASUAL GARMENT

For nearly two decades, the Textile and Apparel (T&A) industry has been a major contributor to India’s GDP and has also provided employment to a large percentage of the country’s population. The industry has also been crucial in terms of overall industrial production and earning foreign exchange through T&A exports. The availability of such raw materials as cotton, silk, wool, and jute, apart from India’s competitiveness in skilled labor, has provided unique advantages to the T&A industry. India’s GDP in 2013 was estimated to be USD 1.82 trillion of which 5.2% came from the T&A industry. The domestic industry constitutes 3.2% while the T&A exports market contributes around 2% to India’s GDP. The domestic T&A market, which is larger than the exports market, reached USD 59 billion in 2013 while the exports market was worth USD 36 billion.

In 2013, the organized domestic apparel retail market was worth USD 8 billion, making it one of the largest contributors to organized retail. The apparel industry is also increasing its focus on organized retail, given that overall organized retail is expected to constitute 28% of the total retail market by 2018. The apparel retail market is being formalized further with the increased penetration of multi-brand outlets, exclusive brand outlets, departmental stores, discount stores, and hypermarkets. The emergence of e-tailing and m-commerce have also boosted the growth of organized retail in India.

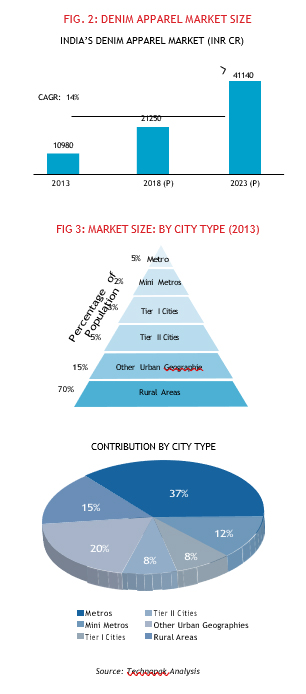

This increasing penetration of apparel brands through various retail formats in India has led to an increase in the purchase of ready-to-wear apparel, and weakened the trend of purchasing ready-to-stitch clothes. Consumers in urban cities prefer ready-to-wear apparel due to the convenience and time-savings offered by directly buying well-fitting apparel. Branded retailers also offer color, design, and style options which give consumers options from which to choose. One of the most important and fastest-growing segments within the ready-to-wear category is denim. India’s denim apparel market is estimated to be worth INR 10,980 crore and is projected to grow at a CAGR of 14% to reach INR 21,250 crore by 2018. The core consuming age group of 15 to 39 years is projected to widen to 566 million from the present 499 million over the next decade; this will propel further growth in consumption. Again, India is currently among the countries with the lowest median age, viz. 26 years, and 65% of the population is younger than

35 years. This population is more aspirational and aware, has higher spending power and is therefore consuming a greater number of lifestyle categories, like denim, compared to their parents.

The growth of denim apparel is also driven by the increasing acceptance of denim within India. Consumers, especially the youth, in cities beyond the metros and mini metros are exceptionally aspirational. They are increasingly accepting denim as a core apparel category to be worn as an everyday casual garment. Women in the smaller cities, who were once not comfortable with western clothing, now tend to combine denims with short kurtis or tunics. Even middle-aged women are experimenting with denims across fits and styles. Rural India is also projected to contribute significantly to this growth as a consequence of the increased penetration. This growth is expected to be sustainable given the increasing income

levels in the smaller cities and the growing casualization of the consumer wardrobe. Tier I, Tier II, and other urban geographies together contribute 36% of the market while rural areas contribute 15 percent.

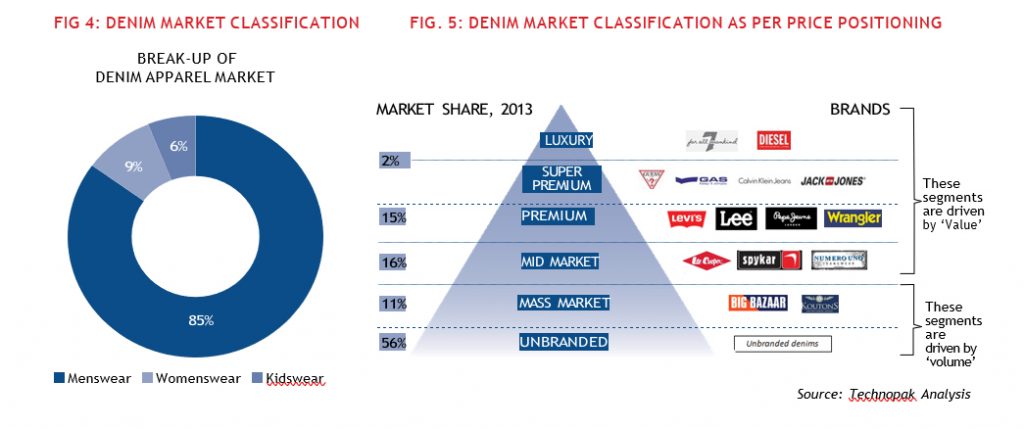

The market is presently skewed towards the men’s segment which comprises ~85% of the total. This is expected to grow at a relatively high CAGR of 14% from 2013 to 2023. The increasing acceptance of such casual concepts as Friday dressing at work has led to an increase in the percentage of denims in the wardrobe. Leveraging this trend, various generic formalwear brands have extended their product portfolio to denims as well. They keep clean washes in traditional fits which can be worn to office or at semi-formal occasions. Youth, especially boys, consider denim as everyday all-occasion wear. Indeed,

denims are a ‘second skin’ for this consumer segment and sported at nearly all times. The type of denim however varies with occasion but spans fit, style and color.

The women’s segment is expected to grow faster, at a CAGR of 15%, largely due to increasing penetration. The women’s and kids segments currently make up only a small share but thanks to increasing urbanization and acceptance these segments are projected to grow faster. Due to the growing influence of western culture, growth over the next decade will be highest in such categories within women’s apparel as denim. The increase in the number of working

EVEN MIDDLE- AGED WOMEN ARE

EXPERIMENTING WITH DENIMS ACROSS FITS AND STYLES.

RURAL INDIA IS ALSO PROJECTED TO CONTRIBUTE SIGNIFICANTLY TO THIS GROWTH AS A CONSEQUENCE

OF THE INCREASED PENETRATION

women has impacted social dynamics and economics in India. Until the previous decade, women’s wardrobe was largely dominated by ethnic wear. Women now have a changed lifestyle which comes with added activities and outings. As a result, they have comfortably accepted denims and other western wear subcategories as an integral part of their wardrobe.

Within the kidswear category, denims will grow at a CAGR of 15% between 2013 and 2023. Such denim styles as pants, shorts, skirts, and dresses are considered to be fashionable and comfortable by both

parents and kids. In boys wear as well as girls wear the denims category remains the fastest growing. Brands are now reexamining their product portfolios and making more styles available in denim fabric across product types. The need for clothing for such occasions as playtime, shopping, parties, and hobby classes is also driving the growth of this category.

Denim brands can also be classified based on their ‘premium-ness’, and cater to different price points. The luxury, super-premium, premium, and mid-market segments made up 29% of the total Indian denim market in 2013, with growth mainly due to an increase in the ‘value’ of sales, which in turn were driven by shoppers having higher disposable incomes, alongside a greater brand consciousness and a propensity to pay more for superior products. Brands in the mass market and unbranded segments made up for a staggering 71% of the total denim market in 2013. The key factor responsible for this growth is the ‘volume’ of sales resulting from an increasing penetration of brands

into Tier II and Tier III cities and the desire among consumers in smaller cities to possess the same share of aspirational brands as consumers in metro cities.

Apparel as a whole has demonstrated a high receptivity to organized retail. The share of corporatized retail in apparel has

increased from a mere 14% in 2008 to 19% in 2013, and is expected to grow further in the years to come. This trend, of a widening organized apparel market, in turn signifies a bright future for the organized denim

market, which is therefore expected to grow at a rapid pace. Since unbranded jeans are a key component of the stagnating unorganized apparel market, its share in the total denim market is likely to fall in future.

The denim market in India is concentrated in a few hands. Of the organized 40% of the denim market, the top 4 players, viz. Levi’s, Pepe Jeans, Lee and Wrangler, account for 50% . As competition from other international brands rises, and as dynamic factors like the rapid evolution of consumers and the emergence of online and mobile purchases, it will become difficult to predict whether these players will continue to dominate the market.

The premium and mid premium segments are expected to register the maximum growth in terms of market share, of 22% and 20.5%, respectively, between 2013 and 2017, with brand and value consciousness among consumers being the key drivers. Even though the unbranded denim segment will continue to dominate for the foreseeable future, its growth is likely to slow down as brand value becomes more important for Indian consumers, and also as existing premium and mid-premium segment denim players enable the growth of the denim market by rapidly expanding into Tier II and Tier III cities in addition to the larger cities. These premium brands focus comparatively more on such product attributes as fit, styling, detailing, and washing in addition to strategic branding and positioning, and are thus able to appeal to target consumers and strike an emotional chord thereby ensuring brand loyalty and higher revenues.

The increasing aspirations of the youth who engage with premium brands will also be fueling this growth. The extant denim players within the premium and mid-premium segment will emerge as key growth drivers and will rapidly foray into the smaller cities in order to leverage the aspirations of for the unbranded segment. This is primarily the impact of globally renowned and respected brands like D&G, Versace, and Hugo Boss widening their product portfolio and adding denim wear, among other categories, for the Indian market. These brands have the ability to generate higher preference especially among the trendsetters and fashion-forwards

in the middle-aged demographic segment who have access to higher disposable incomes and, thereby, the capacity to pay for expensive denim clothing. These luxury brands thus enjoy a sustainable advantage over other lower-end players that compete more on price than on value.

Most of the leading denim brands in India, e.g. Diesel, Gas, Calvin Klein, Levi’s, Pepe Jeans, Lee Cooper, Spykar, etc. display a greater propensity to focus on men’s denim wear. However, as the women’s denim market increases in size, one can expect brands to position themselves to cater to this somewhat neglected but nevertheless essential segment. This widening of the women’s denims market is likely occurring as a result of the increasing penetration popularity of women’s denims in the metros, whether at work or otherwise.

Brands thus need to expend sufficient effort in truly understanding denim consumption among Indian women prior to chalking out and executing the appropriate strategy by which to target this group. Further, for women, a new product category within denims has found increasing acceptance.

Jeggings, a mix between leggings and traditional jeans, are now preferred by young as well as middle-aged women. Fashion/lifestyle brands such as Zara, Vero Moda, and Mango have made them a success and are now a must- have in the wardrobes of both young girls and mid-aged women.

The increasing aspirations of the youth who engage with premium brands will also be fueling this growth. The extant denim players within the premium and mid-premium segment will emerge as key growth drivers and will rapidly foray into the smaller cities in order to leverage the aspirations of consumers from the Tier II and Tier III cities. Volume growth will be the key driver in the entry level segment.

Although the luxury segment is much smaller and is still in the nascent stages, it is expected to register higher growth rate, i.e. 14%, compared to 12% for the mass segment and 10% for the unbranded segment. This

is primarily the impact of globally renowned and respected brands like D&G, Versace, and Hugo Boss widening their product portfolio and adding denim wear, among other categories, for the Indian market. These brands have the ability to generate higher preference especially among the trendsetters and fashion-forwards

in the middle-aged demographic segment who have access to higher disposable incomes and, thereby, the capacity to pay for expensive denim clothing. These luxury brands thus enjoy a sustainable advantage over other lower-end players that compete more on price than on value.

Most of the leading denim brands in India, e.g. Diesel, Gas, Calvin Klein, Levi’s, Pepe Jeans, Lee Cooper, Spykar, etc. display a greater propensity to focus on men’s denim wear. However, as the women’s denim market increases in size, one can expect brands to position themselves to cater to this somewhat neglected but nevertheless essential segment. This widening of the women’s denims market is likely occurring as a

result of the increasing penetration popularity of women’s denims in the metros, whether at work or otherwise.

Brands thus need to expend sufficient effort in truly understanding denim consumption among Indian women prior to chalking out and executing the appropriate strategy by which to target this group. Further, for women, a new product category within denims has found increasing acceptance.

Jeggings, a mix between leggings and traditional jeans, are now preferred by young as well as middle-aged women. Fashion/lifestyle brands such as Zara, Vero Moda, and Mango have made them a success and are now a must- have in the wardrobes of both young girls and mid-aged women.

THE EXTANT DENIM PLAYERS WITHIN THE PREMIUM AND MID- PREMIUM SEGMENT WILL EMERGE AS KEY GROWTH DRIVERS AND WILL RAPIDLY FORAY INTO THE SMALLER CITIES IN ORDER TO LEVERAGE THE ASPIRATIONS OF CONSUMERS FROM THE TIER II AND TIER III CITIES

Luxury brands offer a higher percentage of accessories such as belts, bags, wallets, perfumes, and shoes which also contribute to their revenues. Consumers also exhibit the tendency to buy accessories from a luxury brand, especially when they do not possess sufficient disposable

income to purchase the expensive core products offered by such brands but still want to associate with that brand. This also fulfills their aspirational needs to a certain degree.

Brands in the luxury and premium segments, e.g. 7 for All Mankind, Diesel, Guess, etc., focus highly on innovation and design alongside having a good selection of denim wear for women. Fabric quality and washes are researched thoroughly prior to the start of any season’s development.

Mid-segment brands like Levi’s, Lee, Wrangler, etc. typically focus on the youth who are forward-looking in their fashion choices and offer products that are trendy yet affordably priced. Meanwhile, mass segment brands including Lee Cooper, Spykar, Numero Uno, Flying Machine, etc. boast of much variety in styles and fits but their focus is on making products available at the most competitive of prices.

When consumers look for a denim brand, they essentially look at product variety, different colors and styles, and price. Brands therefore need to focus on meeting these fundamental expectations, and, equally, foster brand awareness and amplify positive brand associations, which can result in customers staying loyal and thus keep the company competitive. High- impactful branding is thus a must for denim brands and retailers.

Another significant trend having a huge influence on both the front-and back-end of the denim, as well as other T&A, business is the implementation of sustainable and/or responsible business strategies. Global apparel companies are becoming more conscious of their environmental footprint and are implementing corporate social responsibility programs to counteract various issues. Companies with such a sustainable outlook adapt their design, production, distribution, and promotion strategies in order to offer socially- and environmentally-responsible products and services profitably. For instance, the global denim giant Levi’s launched a ‘water-less’ collection of denim, whose production employs much less water during the processing and

finishing stages as an attempt to reduce water usage. Further, some brands are using organic denim fabric as an integral part of their product range. In India as well, large denim fabric mills are altering their manufacturing strategies and working towards reducing their impact on the environment while socially uplifting farmers and employees. Vocational training programs and better work facilities with greater sanitation, for instance, are being provided by these mills. Working towards building a responsible brand has become a necessity within a global environment. Consumers are becoming more cautious about the apparel they wear and its lifecycle. They are keen to know about the entire manufacturing process before making a purchase.

Hence, implementing sustainable strategies is of utmost importance.

From the manufacturing perspective, brands and retailers are pressurized by the constant rise in cotton price which have resulted in reduced margins.

Manufacturers are thus continuously developing alternate strategies and also using different fabrics to deal with this inflationary trend. Also, within the denims export market, there is strong competition with other manufacturing countries like Bangladesh, Pakistan and Indonesia. Cheaper labor costs provide an added advantage to these countries by reducing the overall cost of production. Consequently, international brands tend to, by and large, source from them. Indian manufacturers must find alternative strategies and differentiating factors such as a smoother supply chain or value-added products in order to remain competitive.

Apart from the above trends, in India, the increased penetration of digital technology cannot be ignored. Between 2013 and 2019, the number of smartphone users is expected to increase rapidly from 65 million users to a stunning 365 million users. The number of mobile phone, PC and notebook users too is also expected to surge. This deep penetration, alongside improved access to the Internet, is, needless to say, rapidly impacting consumer behavior. Online and mobile phone-based shopping is gaining momentum among Indian shoppers especially in the metros, and it is expected that such purchase behavior will become a norm even in the Tier II and Tier III cities.

However, despite the rapid burgeoning e-commerce as a result of such record penetration of digital technology, it is believed that online purchasing of denim wear has not yet become as popular in India as such other apparel and non-apparel categories as electronic goods, although it does have the potential.

This is possibly because selling denim jeans online is indeed a challenge. Jeans represent a high- involvement and highly customized category, and shoppers want to personally feel and see how the product fits them before making a purchase decision. Again, finding the perfect pair of jeans is complex. For instance, if we look at different cuts for women’s jeans alone, there is the classic cut, relaxed fit, boot cut, boyfriend style, tapered, skinny jeans, jeggings etc.

Further, denim brands usually have a strong heritage and thus claim different associations with their audience. They portray themselves through diverse expressions, such as modesty, sex appeal, relaxed nature, and nonchalance. Brands’ marketing strategies are based on this same set of associations in the physical store space. However, websites are not able to evoke the same degree of inspiration in the minds of the consumers and thus do not generate huge online sales. Websites of denim brands need to display brand aesthetics, image, and story just like physical stores.

Some global brands have been able to deploy their websites as a strong

communications tool as well as a sales portal. Indian denim companies can adopt best practices from those in the west, and aim to improve their online offerings to achieve more success in denim e-commerce.

An intuitive and easy-to-navigate company website, which provides an online shopping experience consistent with the company’s brand image, is thus a necessity to ensuring online sales.

Information presented on such websites should not be cluttered and the website should have a casual, classy, trendy, or prestigious feel depending on what the denim brand stands for. Websites do not simply solve the issue of generating additional sales online, but also assist in web-to-store traffic generation. ‘Webrooming’, for instance, is a trend gaining traction which involves browsing for a product online first, and then heading down to a physical store to make a purchase.

Indian companies can also do a better job in clearly representing various

fits, sizes, colors, and any discounts available through their websites, just

like some of the global jeans brands which have a successful online presence. These global brands also do a good job of incorporating exclusive denim offers available through their online portfolio via ‘online only’ products. This brings in the concept of ‘exclusivity’ and engages the online consumer by encouraging repeat visits, and thus registers an increase in sales.

What matters substantially in terms of online denim sales is the brand.

Given that consumers cannot “touch and feel” the product when they

buy online, companies which have already established a high degree of brand familiarity and a positive brand association are more likely to achieve success. These supply the confidence required among target consumers that the product they seek to buy will deliver on the promises and quality of the familiar brand, and that there will likely be no unpleasant surprises.

Social media platforms can also be leveraged to maintain customer loyalty and remain in the shopper’s consideration set. Looking at the Twitter and Facebook presence of premium brands in denim wear, one can notice that they have put in sufficient efforts, and are therefore more aware of Sits importance than non-premium denim players. Instagram, Pinterest and YouTube are other channels on which a company should remain active in order to constantly engage with the modern consumer. Some luxury brands do a fine job of showcasing products online in a manner that is consistent with the brand’s premium nature– and emphasizing that the merchandise on the online platform can be as

equally important as merchandise in a physical store.

Indian denim retailers can also collaborate with multi-brand online stores such as Flipkart, Yepme, Jabong, and Myntra which can help in managing warehousing and distribution costs, and reach places where the

lack of extant infrastructure makes distribution difficult.

Smartphone applications are technological innovations that have become mainstream in the West, and in due time are expected to achieve a high degree of penetration within the Indian apparel market as well. This enables consumers to look up a product through their smart device and also compare prices, read reviews, and order the product instantly.

At the global level, innovations such as 3D body scanning have the

potential to be a game-changer, giving consumers an almost perfect way of finding the right fit of jeans without even trying them on. Brick-and-mortar stores will have booths equipped with advance 3D body scanners using low power infra-red lights which can read up to 300 thousand points on the customer’s body in less than 10 seconds. A stylist then analyzes the body mapping and recommends a flawless fit. This information can be stored and used for all subsequent purchases including online and mobile sales. While this technology is already over a decade old, it is expected to attain significant adoption in the near future as more and more retailers realize its importance.

Features like free and speedy delivery with a cash-on-delivery payment option, no-hassle returns within a considerable time frame, and paid return-postage add to increasing the confidence level of online purchasers. To attain online success, brands have to provide a compelling view of what they offer, explain why their products are relevant to consumers, and make it easy to transact online.

In today’s dynamic world change happens at a rapid pace. This is especially applicable for a technology- driven field like e-commerce. In such circumstances, it is difficult to accurately predict what will follow in the decades to come for online denim sales, but one can still speculate on the broad level trends that are likely to have an impact.

Conclusion

The denims category shows the promise of growth within the Indian apparel segment. With more international players making their presence felt in India, it is important for domestic brands to alter their strategies in order to remain competitive. The existing brands must focus on new products, distribution, retailing, and marketing strategies. Their product range must be fashion-forward while mixing men’s and women’s styles. Alternate retail channels can also be explored. Brands can use social media to their advantage and build connections with their target audience. It is important for brands to find the right positioning and then, accordingly, formulate the price, product, and retail strategy.

Manufacturers must focus on developing fabrics and finished denim apparel at different price points or must provide smooth supply chain advantages. The need to focus on responsible manufacturing is also gaining momentum.