Brands must learn to step back and allow consumers to be the creative centre of innovation…

For the last two years, consumers have had a community mindset, putting their own needs on the back burner to prioritise public health and safety. People are now emerging from the pandemic eager to re-focus on themselves, and brands can help them take centre stage in the years to come.

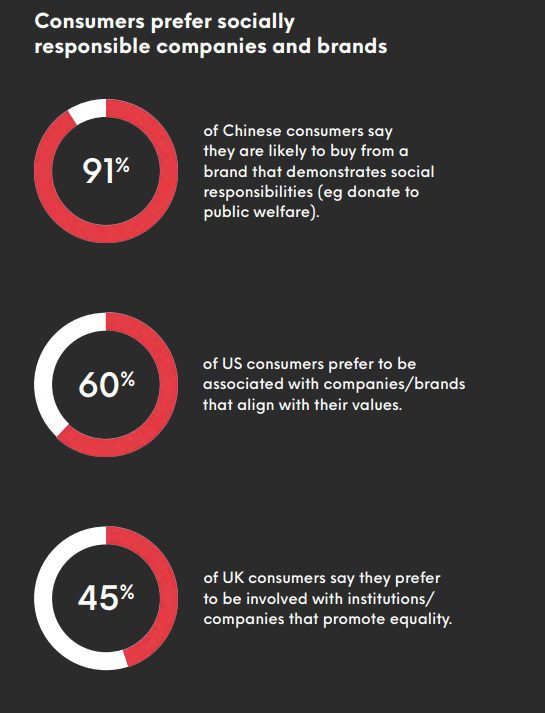

Consumers are shaping brands with their dollars and their voices. This idea goes beyond brands conceding that ‘the customer is always right’ and is evolving into a model where consumers are investing, co-creating and voting for change alongside brands. Responding to this demand requires brands to listen from the backseat while keeping one foot on the gas to create market innovation.

Case Studies

- IKEA and H&M: In the UK, IKEA and H&M have partnered to create an ‘ideas factory’—a joint project that invites creatives, designers and small-scale manufacturers to submit ideas across categories for development into marketable products

- Decathlon: Athletic retailer Decathlon has developed a data lab in Singapore to combine efforts between its experts, industry partners, entrepreneurs and students to bring new products, practices and processes to its business.

NFTs (non-fungible tokens) and Web3 communities are opening up new channels for consumers to invest in brands. The novelty of NFTs is waning, but the utility of these digital assets is growing. Brands are using NFTs as a way for consumers to own a piece of a brand and directly connect them with a brand’s overall success and growth. Beyond just collectables, brands are designing NFTs that, when purchased, offer entry into rewards programmes, membership clubs and even profit sharing. NFT holders are given early access to new product information, voting rights and essentially a seat at the table. In these ways, over the next two years, expect to see digital assets become a point of entry for action-oriented consumers who want to help shape the direction of the brands they love.

- Starbucks: Starbucks is integrating NFTs into their new Web3 experience for rewards members, Starbucks Odyssey. These digital assets will take the form of collectable stamps that programme members can buy and sell within the Odyssey marketplace.

The ‘Me’ Mentality – What’s Happening Now

Identity is built on the daily routines and habits that accumulate over the years. The pandemic disrupted much of this routine, leaving people with an opportunity to redefine who they are. Brands are recognising this growing need for people to solidify and celebrate their individuality. They are responding by offering new opportunities for experimentation and self-expression. Brands can lean on trial periods to help encourage new routines as consumers begin to act on the idea that they do not need to be the same person they were in the past.

Consumers may want to stand out rather than blend into the crowd but might not know how to do so. By celebrating the interests that make consumers unique, brands can help give consumers the assurance they need to try something new or even help them rethink who they are. Consumers are ready for a confidence boost, and brands can provide this to them in the form of new experiences or products that feed their curiosity as they form new tastes, routines and preferences that align with who they are or who they want to be.

- Nike: Nike Korea opened a tech-equipped experiential store in Hongdae, South Korea, optimising the store format to enable consumers to explore their style. The fitting rooms are equipped with special screens where consumers can choose their background, filter and stickers to create their own ‘look’.

What’s Happening Next

As consumers look to build up new parts of their identity, brands can help fill in the gaps with offerings that help them grow their skills and gain mastery in new areas. Consumers want to quickly move forward and make up for lost time, diving into their preferred pursuits with gusto, seeking personalised products and services that match their skill level. At the same time, consumers will look for ways to become more resilient to change as they prepare for the uncertainties of the future.

Demand for mental health and wellness-focused products will grow as consumers look to understand their blind spots and actively work to overcome them. Brands can address this desire for clarity about the future by tapping into the spiritual practices or moral beliefs that consumers follow and engage with, even turning to the interests of astrology-obsessed consumers for inspiration.

Case Studies

- ColourPop Cosmetics: Los Angeles-based cruelty-free and wallet-friendly beauty brand ColourPop Cosmetics is helping consumers explore new products based on their zodiac sign, starting with its Pisces Starter Pack.

- Bulgari: Italian luxury brand Bulgari has launched a new activation in the Samaritaine department store in Paris allowing shoppers to personalise the brand’s fragrances and scarves.

Buying Local

Buying local will be a way consumers can protect themselves financially, environmentally and psychologically, and feel that they are giving back.

With so much global uncertainty (eg surrounding the economy, sustainability, supply chains and conflict), there will be a greater movement to protect local resources and boost local business. This is a hangover from the pandemic, but also a reflection of consumers’ changing attitudes towards what’s important to them—a reconnection with ‘local’ is also a way for consumers to protect themselves financially, environmentally and psychologically, and feel that they are giving back in some way.

Over the next two years, consumers will continue to grow more bonded to the local environment as the world faces rising geopolitical and financial insecurity. Many will continue to support local economies and communities and seek ways to connect locally—deepening the spirit of shared identity. Consumers will respond instinctively to home-grown innovators and brands that stamp their authenticity on the items they produce and sell. With this in mind, both international and local brands could benefit from collaborating with local artists or coming up with schemes to support the specific needs and behaviours of local communities. To do this authentically, brands will need to let local communities and creators not only participate in, but also take charge of projects.

Additionally, protecting local businesses and products will no longer be limited to those located geographically nearby and could likely evolve into a global sense of international localism. ‘Localism’ will come to mean supporting communities where the product is manufactured rather than where the consumer is located. Indeed, empowering communities across the world will play a significant role in consumers’ interest and brand loyalty. Global brands can capitalise on this by highlighting how their local stores, employees or profits are being used to better each of the communities in which they are present.

- Adidas: Adidas has launched limited edition sneakers with Dubai Pakistani restaurant Ravi. The collaboration is part of Adidas’ collaborative project with 11 small and local restaurants in 11 cities around the world to recognise the community spirit created in and around local restaurants.

- Umbro Argentina: Sportswear brand Umbro Argentina invited fans of the football team Rosario Central to show off their team-related tattoos for the chance to have their tattoo featured on a limited edition version of the team’s football shirt.

- Suay Sew Shop: Los Angeles-based sewing and production shop Suay Sew Shop – aimed at creating a culture of community and reuse – started putting on monthly clothes-dyeing events to extend the life of clothes.

Socially Responsible Brands

Brands will re-evaluate their supply chains and reliance on other countries. For instance, the conflict in Ukraine has highlighted the vulnerabilities of supply chains and potential disruptions to global food security. In the longer term, this will lead brands to explore strategic shifts towards the use of domestic raw materials, if available, or at least to a more diversified sourcing structure—and not just in the food and drink category.

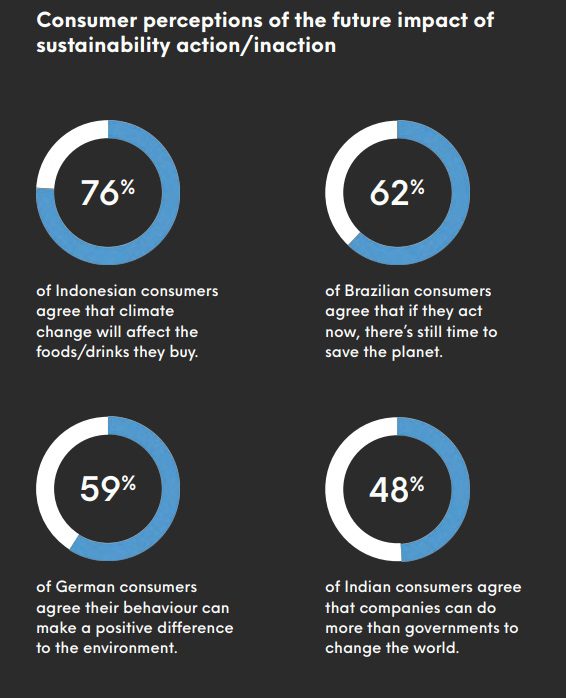

Global supply chains will not go away, though. As the impact of global warming will increasingly be felt, more consumers will be scrutinising whether global brands take their local commitments seriously. For example, eco-conscious consumers will demand the traceability of raw materials and more transparency around how brands are conserving local resources, especially in the developing world. Consumers will want proof of a brand’s ethical credentials, which could go beyond environmentfriendly positioning and include corporate practices too.

Factors like flexibility, durability and sustainability will play increasingly important roles in consumers’ value equation.

In response to price increases across all categories, consumers are forced to continually re-evaluate their priorities and their budgets. From ‘Let’s try this brand instead, it’s a little cheaper’ to ‘Let’s see if I can go without it this month’, consumers are exploring, comparing, and removing items from their carts to ensure their needs for today and goals for tomorrow can be met. The next 12 months will be intensely competitive as brands seek to gain new or retain existing consumers through value-for-money propositions.

From bulk discounts and price freezes to more mass brands stepping up with premium cues (eg aesthetics, scents, effectiveness of ingredients or sustainability), consumers will be drawn to the products that provide the best bang for their buck.

Future Forecast: Recent events have shown consumers how interconnected the world is and more are increasingly concerned about the future, the environment and the communities impacted by their everyday choices and habits. In five years and beyond, expect to see purpose-driven brands emerge with tangible plans and innovations that address long-term challenges faced by the industries, nations and communities they’re a part of (and those that have remained unaddressed for too long). Consumers will seek value in purpose, supporting trustworthy brands that make a difference as they make a profit, to ensure their everyday consumption choices align with the future they aspire for.

Future Forecast: Recent events have shown consumers how interconnected the world is and more are increasingly concerned about the future, the environment and the communities impacted by their everyday choices and habits. In five years and beyond, expect to see purpose-driven brands emerge with tangible plans and innovations that address long-term challenges faced by the industries, nations and communities they’re a part of (and those that have remained unaddressed for too long). Consumers will seek value in purpose, supporting trustworthy brands that make a difference as they make a profit, to ensure their everyday consumption choices align with the future they aspire for.

Conclusion

In the next five years, brands will increasingly cater to the niche identities of loyal consumer investors, fragmenting large, legacy brands into smaller, more targeted business units. For consumers, a new era of social signalling will emerge as they feel more intertwined with the ethics of the brands in which they’re invested. What people wear, eat and drive won’t just signal status, but will be a detailed account of their attitudes and beliefs.

Advances in technology that allow for extreme personalisation across categories will leave less room for mass market products to drive collective appeal. When brands find themselves navigating controversial issues, they will have a roadmap to follow, guided by the activist consumers they serve.